July 2019 Update

We launched BearNBull over a year ago and I am proud to see how our application has evolved. We continue our work to support more features and serve more users. We’ve received tons of feedback during the past few months, which has been guiding our improvements. I am excited to announce a fresh update to BearNBull, addressing many of our users’ requests. Here are some of the new features that we now support:

Flexible Timeframe

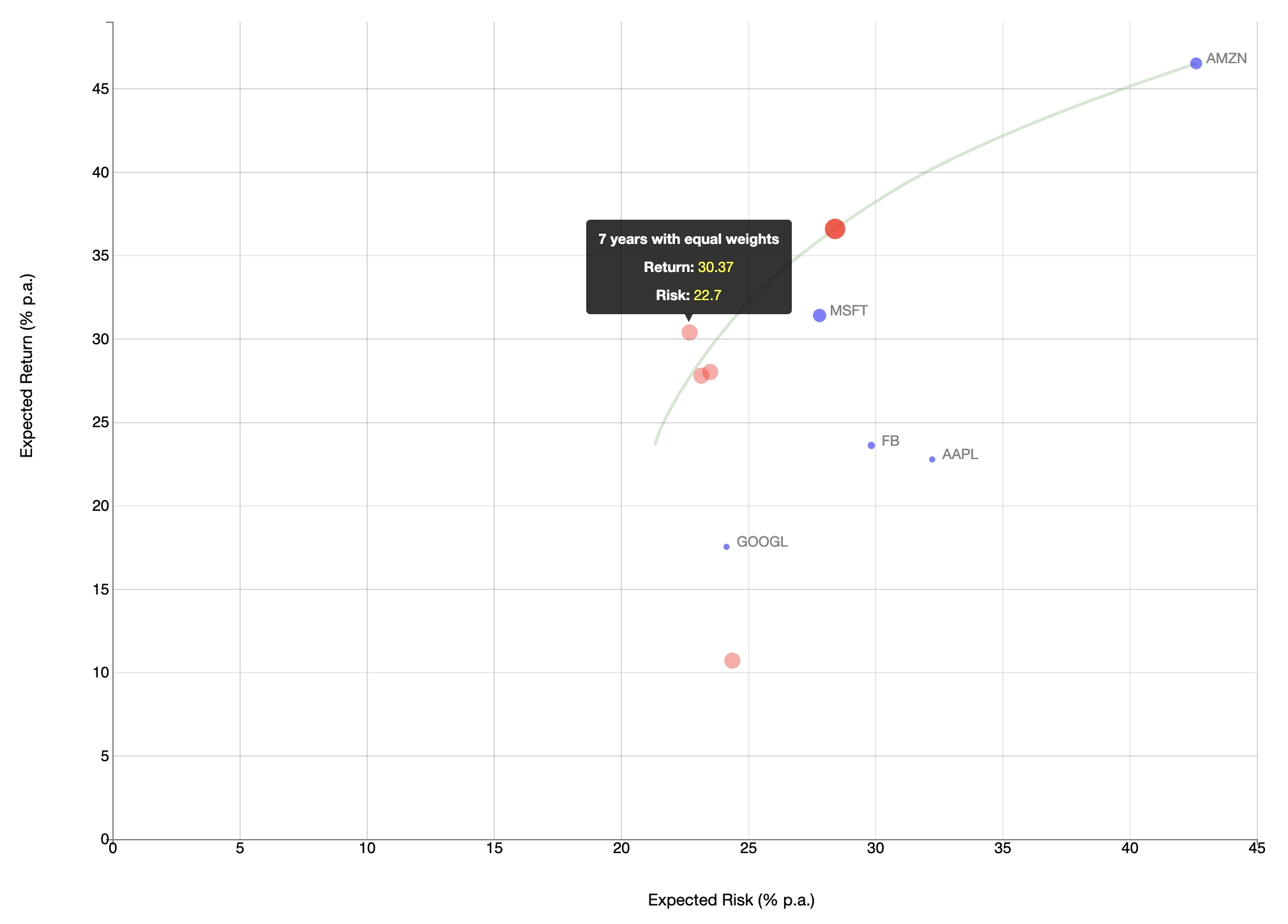

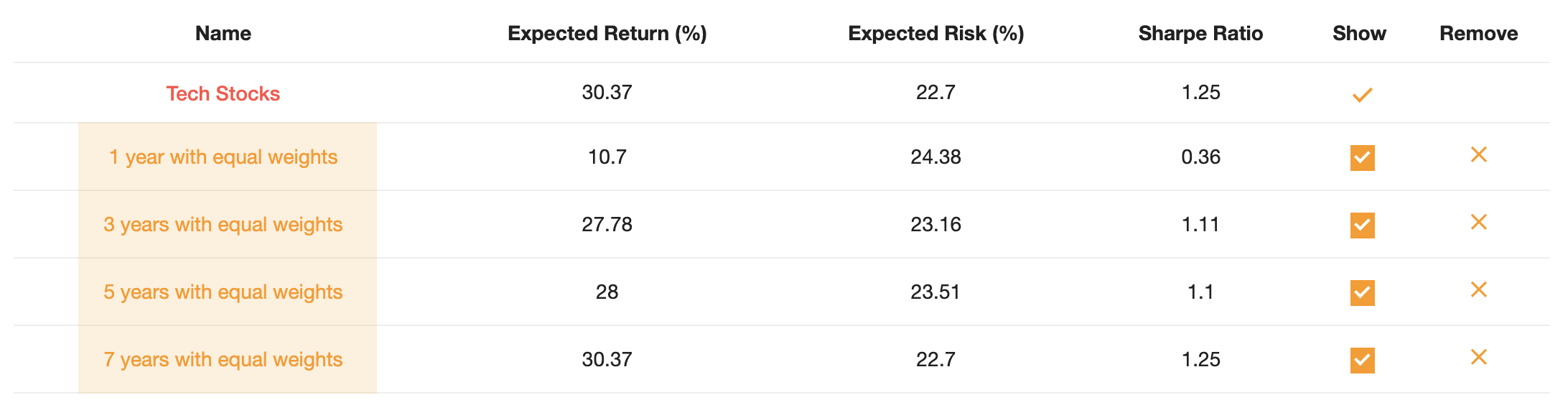

Set a start and end date for the historical data used in the portfolio analysis. Quickly compare short versus long term trends. And analyze recently launched assets, which only have a few months of data available.

When coupled with portfolio snapshots, it's easy to compare all portfolio results on the same graph and switch from one timeframe to another.

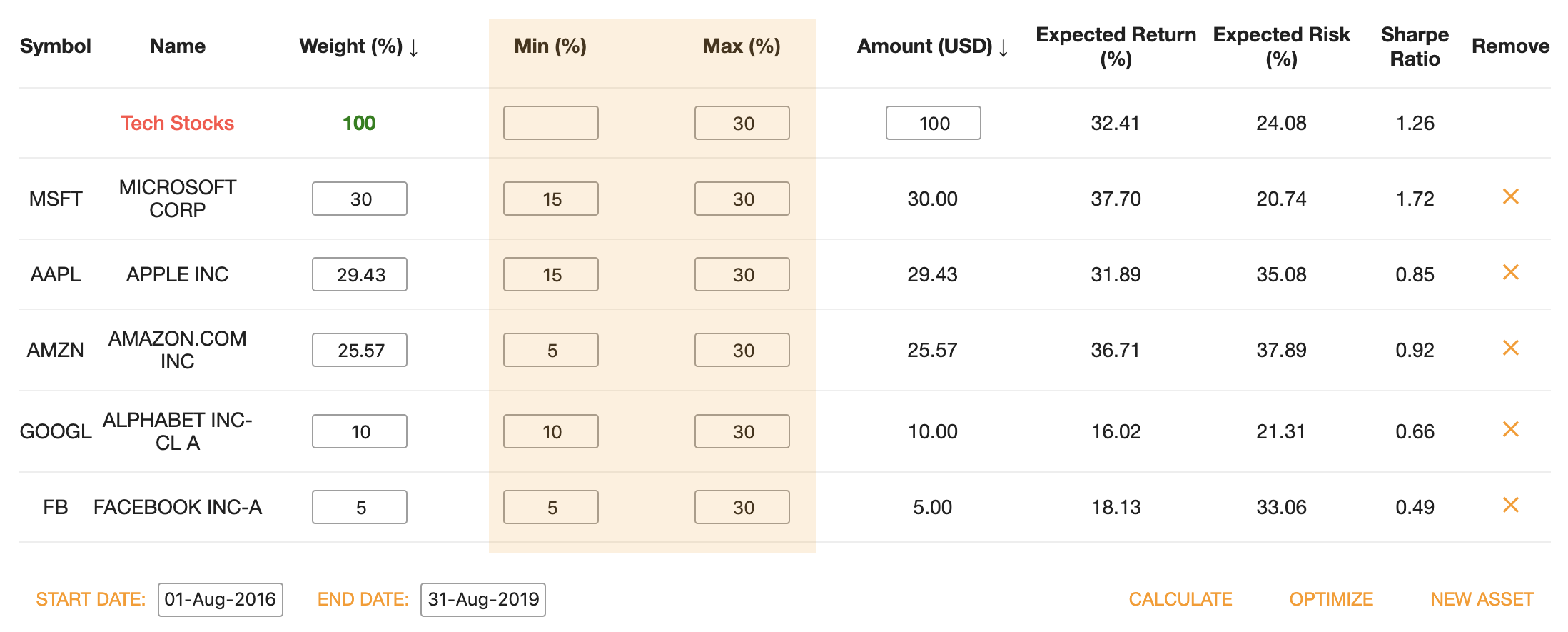

Min and Max Weights

Set minimum and maximum weight requirements for the optimization. The values can be defined per asset. This is a very useful feature when you don’t want the optimizer to zero the weight of an asset, or when you want to set a maximum exposure to an asset. An Efficient Frontier can still be generated. All portfolios along the Efficient Frontier curve, which are accessed by clicking on the green line, will satisfy the new weight restrictions.

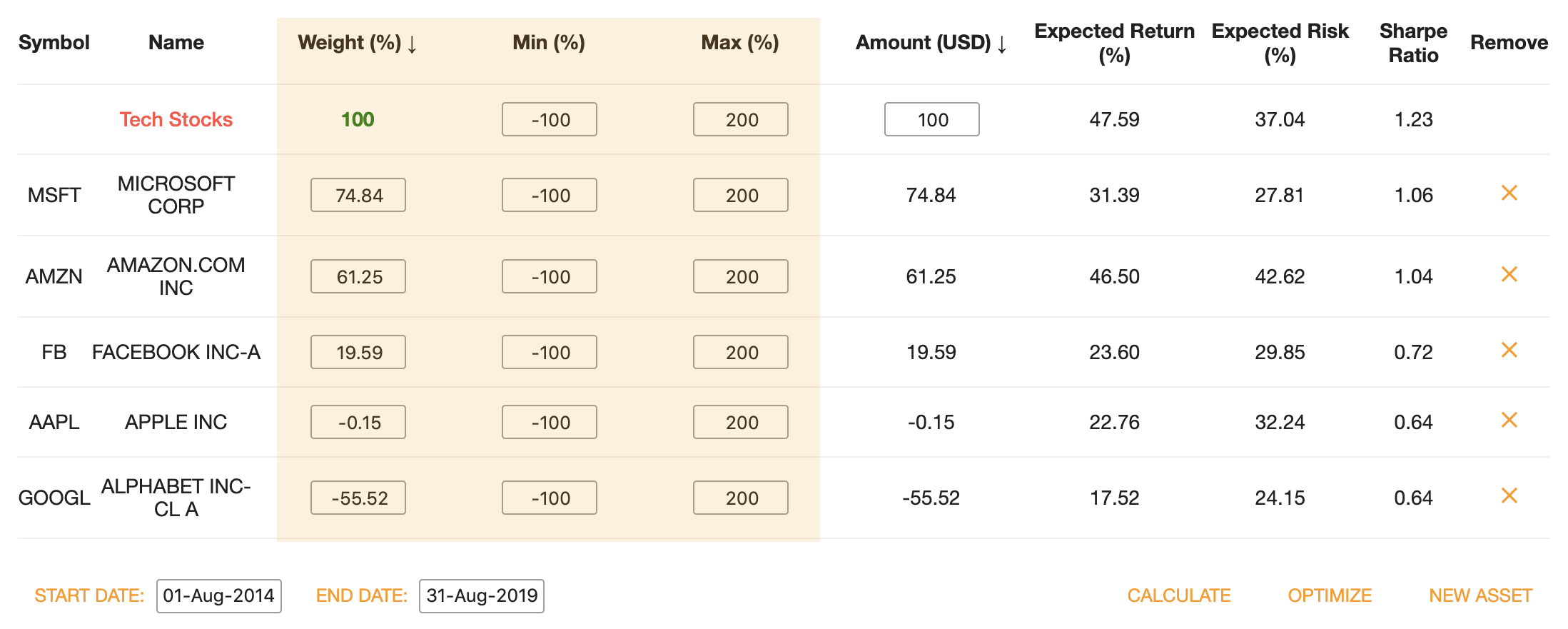

Short Selling

Use negative values for the shorted asset weights. And increase asset exposure by setting weights above one hundred. Optimizing a portfolio with short selling expands the Efficient Frontier. The process is simple: just set negative minimum weights (e.g.: -100) before optimizing to allow short selling. And set maximum weights above one hundred (e.g.: 200) to allow more asset exposure.

Future Updates

Looking forward, we continue to pursuit our mission to build a simple and powerful portfolio analysis application for self-directed investors. As BearNBull grows, we envision the application helping our users with 3 key steps of the investment lifecycle:

- Choosing the best assets

- Allocating assets efficiently

- Tracking portfolio performance

We have a great roadmap of features, which we are currently working on. Remember to reach out with comments and requests you may have. Just send us a note at feedback@bearnbull.com.