About BearNBull

We are excited to introduce you to BearNBull, www.bearnbull.com, an online community for self-directed investors, where you can create, analyze and share portfolios.

At its core, BearNBull is an educational tool for investors. The concept is based on two important learning principles:

- Active Learning, which happens when investors create portfolios, run simulations and analyze the results.

- Collaborative Learning, enabled by the social features of BearNBull, such as sharing, following and cloning portfolios, in addition to engaging in forum discussions with other users.

BearNBull also gives investors a common language to analyze portfolio risk and return. This language is based on Modern Portfolio Theory (MPT), also known as Mean Variance Analysis. MPT is a 1990 Nobel Prize-winning theory, introduced by the economist Harry Markowitz in a 1952 essay. The theory is still very relevant today and adopted by institutional investors worldwide. Unfortunately, only a few cumbersome applications are available for self-directed investors. And most people try to build their own tools, which are basically spreadsheets that can rapidly become complex to use. BearNBull is here to bridge that gap! We abstract all the data gathering and complex math involved, letting users focus on analyzes that will help them make better investment decisions.

We acknowledge that many investors are still not familiar with MPT and we want to spread the word to more people. Our hope, is that those who understand the theory will support the community by sharing their knowledge. This process is part of the collaborative learning principle mentioned, and it is beneficial to everyone involved. That said, we’ll also publish articles and a short video series on the theory behind BearNBull, to help kickstart the discussion. Please let us know if that is something that has value to you.

Features

Here is a quick description of some of the features currently available:

Create Portfolios

You can create an unlimited number of portfolios and each portfolio will hold an unlimited number of publicly traded assets. We currently support thousands of US traded assets, all based on real market data. If you have difficulty finding a specific asset, let us know!

Once you’ve decided which assets will be in your portfolio, it’s time to make your asset allocation decision. Basically, defining what percentage of your portfolio will be allocated to each asset. That is a very important decision, because it affects your overall portfolio risk and return.

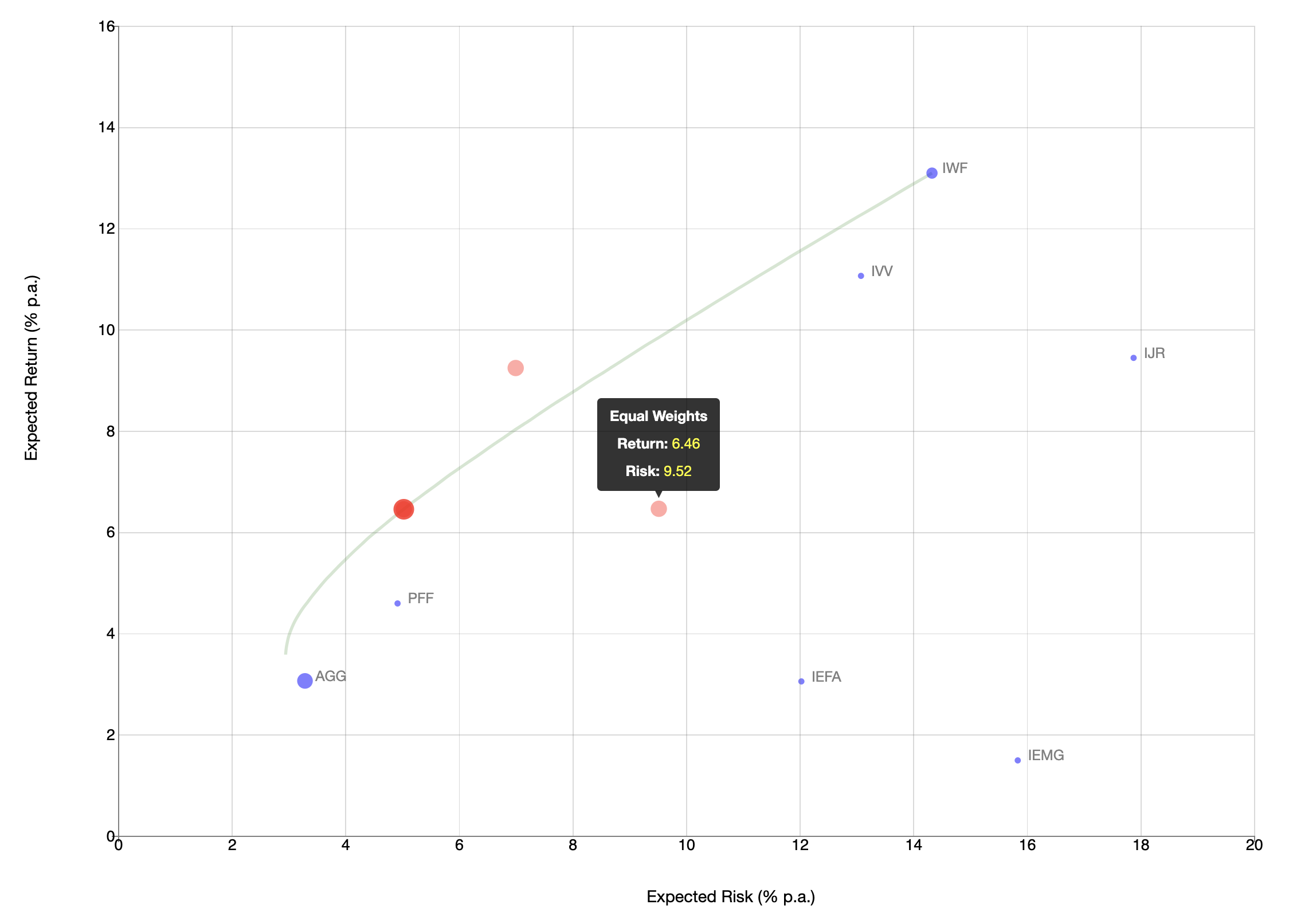

Calculate Risk and Return

After allocating 100% of the weights on your portfolio, you can calculate your overall portfolio risk, return and Sharpe ratio, an important measure of return per unit of risk. You should experiment with changing the weights and recalculating the portfolio metrics. For example, what does an equally weighted portfolio looks like? What about concentrating the weight on a few selected assets? You will see that by changing the asset allocation weights, you can discover portfolios with similar level of risk, but higher expected returns. Or portfolios with similar expected returns, but lower level of risk.

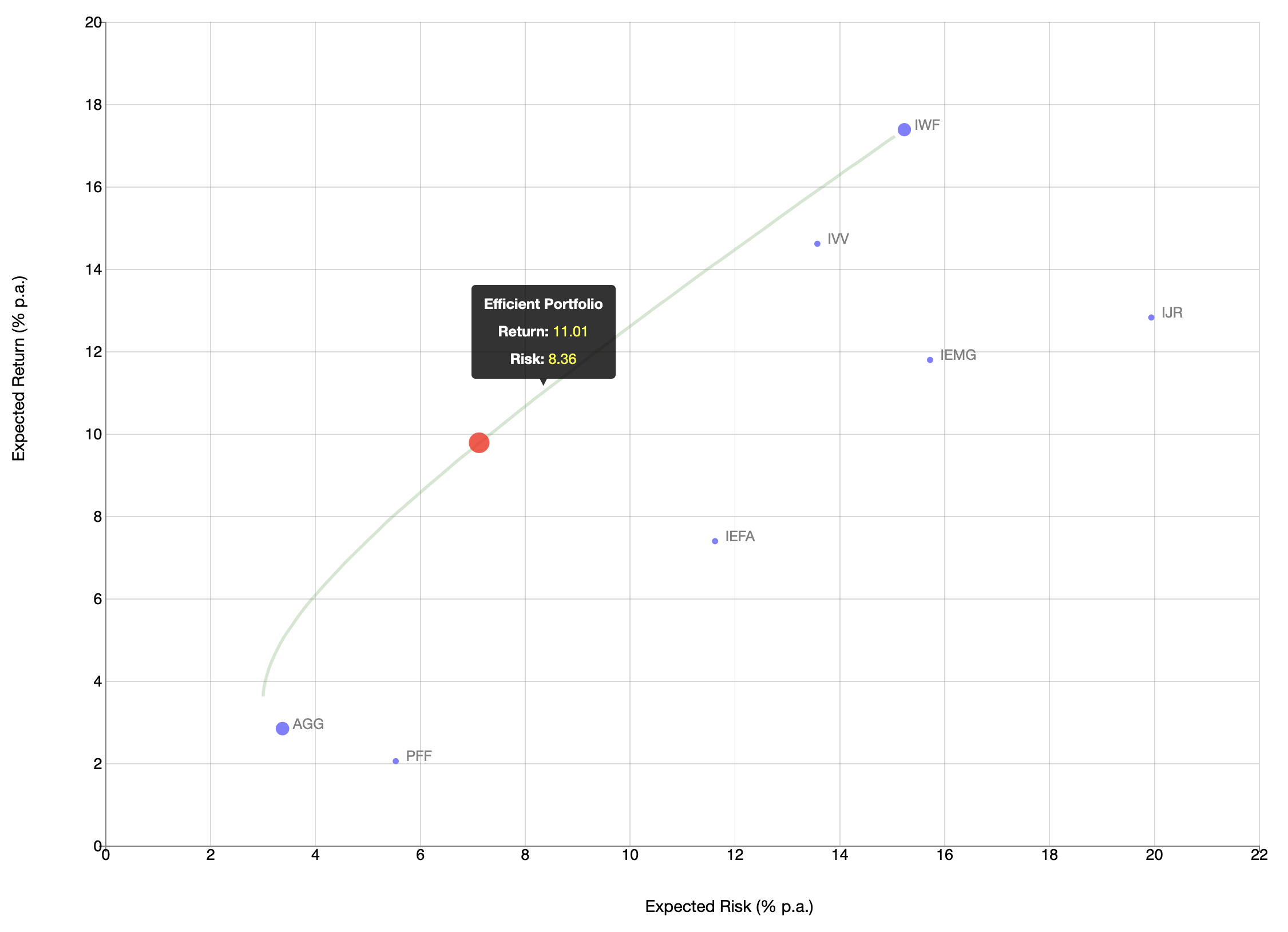

Optimize Portfolios

You can play around with different weights all day, but here is a question to you: which portfolios will maximize expected return for different levels of risk? MPT helps us discover them! BearNBull does exactly that with its Optimize feature. An efficient frontier curve containing all the optimized portfolios is plotted on the graph. You can click at any point in the curve to choose a portfolio and BearNBull will generate the underlying asset allocation. That simple!

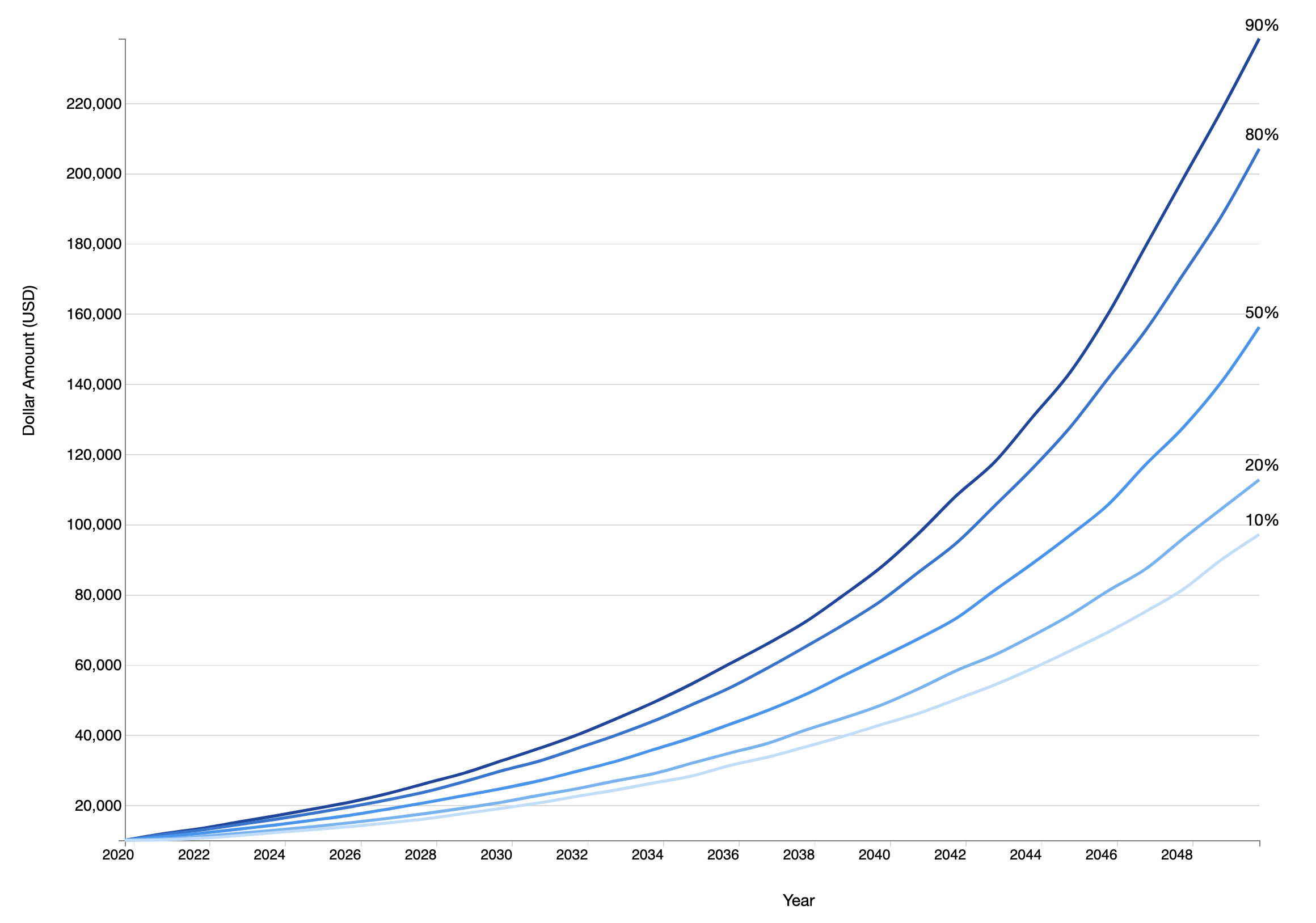

Risk and Return Forecast

Assessing risk by looking at a measure of standard deviation is difficult. To address this issue BearNBull has a risk forecast tool that gives you five different probability outcomes for a specific time horizon. On the background, we are running a Monte Carlo simulation with thousands of iterations on your portfolio data to generate the results.

Portfolio Snapshots

While experimenting with different asset allocation for a portfolio, you may want to compare different versions and quickly switch from one to the other. Our Snapshot feature gives you exactly this functionality. You can compare the results on a table or check the “show” box to display them on the graph. Snapshots make experimenting with different asset allocations a breeze.

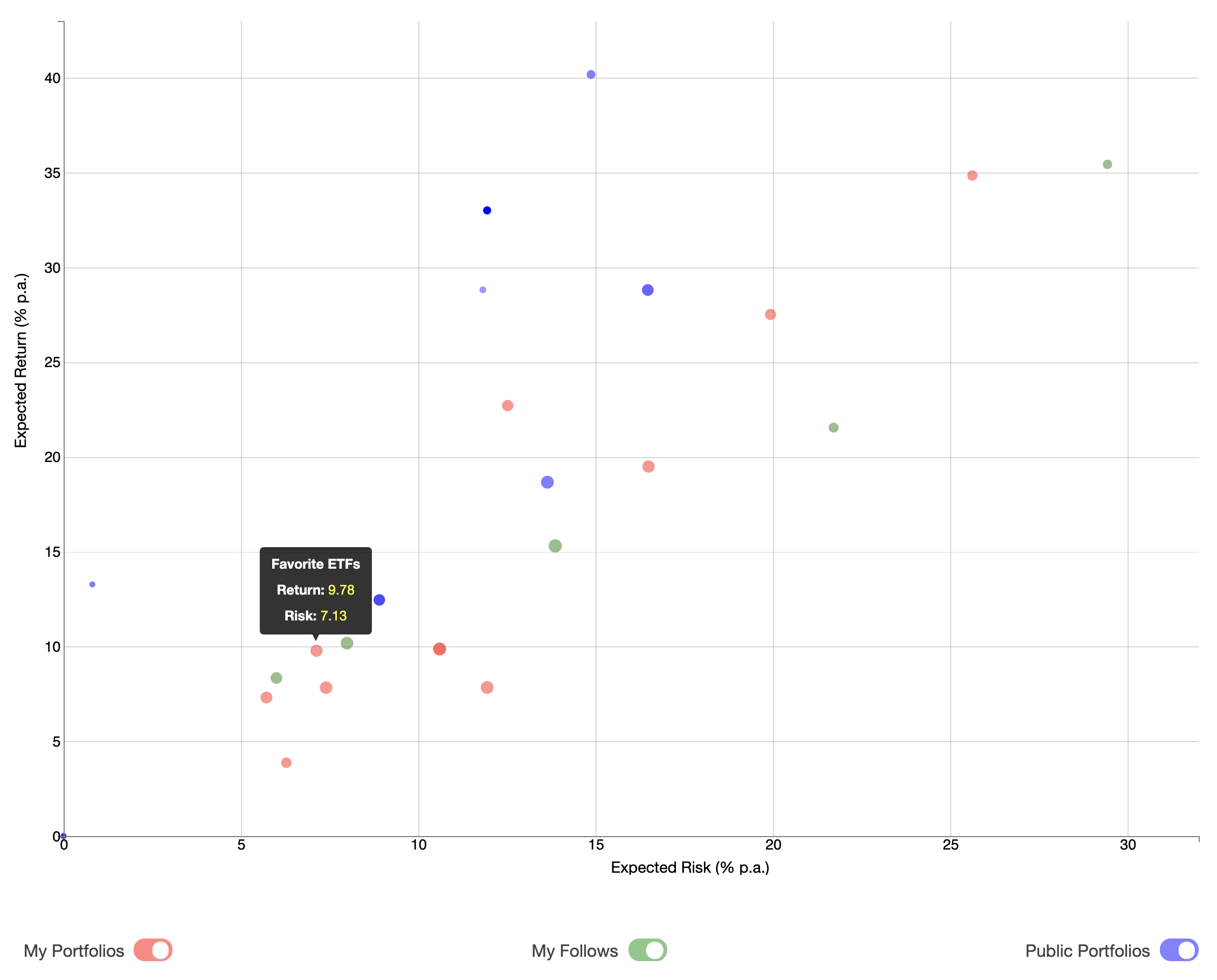

Explore Public Portfolios

There are thousands of assets available in the market. Which ones should you add to your portfolio? Sometimes, exploring other investors’ choices and engaging in productive conversations with them is the best way to find out. While it is possible to create private portfolios on BearNBull and we understand some users need that functionality, the community thrives by making the portfolios public. This is possible because no dollar amount is shared, only the assets and weights distributed to them.

Follow Portfolios

After exploring interesting portfolios, you may want to follow specific strategies. With a click of a button you can add any public portfolio to your follow list, making it easy to track how the portfolio evolves over time.

Clone Portfolios

You may also want to remix a certain portfolio that you like, without having to build it from scratch. Maybe a family member or a friend creates a new strategy, but you want to show them what happens when you add certain assets to it or change the allocation. You can do this with our clone feature, which helps you create an exact copy of any public portfolio for you to remix.

Concluding Thoughts

We encourage you to signup for BearNBull. Most of the features available are FREE to use under our Basic Plan, only a valid email is required to get started. Our Premium Plan (US$ 5 /month), which we recommend, and our Pro Plan (US$ 10 /month) are also very affordable. You can also compare these options at the plans page.

If you like what you’ve seen, share your thoughts with us. If you don’t, please give us your constructive feedback. You can either email us at feedback@bearnbull.com or fill out our quick 2-minute survey. We are excited to hear from you and to keep working on building a great online community for self-directed investors!